-

Courses

Courses

Choosing a course is one of the most important decisions you'll ever make! View our courses and see what our students and lecturers have to say about the courses you are interested in at the links below.

-

University Life

University Life

Each year more than 4,000 choose University of Galway as their University of choice. Find out what life at University of Galway is all about here.

-

About University of Galway

About University of Galway

Since 1845, University of Galway has been sharing the highest quality teaching and research with Ireland and the world. Find out what makes our University so special – from our distinguished history to the latest news and campus developments.

-

Colleges & Schools

Colleges & Schools

University of Galway has earned international recognition as a research-led university with a commitment to top quality teaching across a range of key areas of expertise.

-

Research & Innovation

Research & Innovation

University of Galway’s vibrant research community take on some of the most pressing challenges of our times.

-

Business & Industry

Guiding Breakthrough Research at University of Galway

We explore and facilitate commercial opportunities for the research community at University of Galway, as well as facilitating industry partnership.

-

Alumni & Friends

Alumni & Friends

There are 128,000 University of Galway alumni worldwide. Stay connected to your alumni community! Join our social networks and update your details online.

-

Community Engagement

Community Engagement

At University of Galway, we believe that the best learning takes place when you apply what you learn in a real world context. That's why many of our courses include work placements or community projects.

Making a claim FAQ

Can visitors (e.g. external examiners, interviewees, Údarás members) to the University submit claims using the online system?

No. However, visitors can use the Accounts Payable Travel & Expenses Claim Form.

Which travel type do I choose when entering my claim?

Please choose the appropriate expense type as listed below:

- Subsistence rates including vouched expenses, where the value claimable for meals/overnight allowance etc. is computed by the system in accordance with Civil Service rates based on the data entered by the claimant (departure date/time, arrival date/time, etc.). Claims may also include ‘vouched’ items e.g. taxi fares, parking fees, tolls etc.

- Travel: Vouched expenses only, where the claim value for meals/overnight allowance etc. is less than Civil Service rates and receipts for outlays incurred are attached to the claim.

- Non-travel: Vouched expenses in line with policy QA330, this is vouched claims for small values in line with policy QA330.

May a NUI Galway employee claim for reimbursement of travel expenses for travelling to and from work?

In line with university policy and Revenue guideline, NUI Galway employee may not be reimbursed for travel expenses incurred in travelling to and from their work in NUI Galway. (i.e. anyone paid through HR/Payroll, be they full-time, part-time, salaried, waged, occasional/paid on a time sheet, etc.)

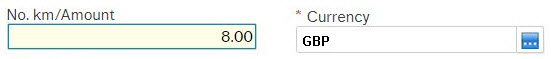

What do I enter if claiming kilometres?

The system doesn't calculate the distance between locations. You just need to enter the amount of KMs travelled in the No. km/Base Amount field.

What are the rates per kilometre?

The rates can be found here.

When should I use VKMS (Vouched KMs) to claim less than standard rates?

VKMS should only be used when claiming less than standard rates

By selecting Kilometers - (b) lower than standard University KM rates you are choosing to manually enter a lower KM rate.

For example if your budget does not have sufficient funds to cover the standard rate you can use this option.

Can I change the "system" currency exchange rate?

Yes - the system automatically updates weekly but it is also possible to change this manually.

Can I change the currency for an expense item?

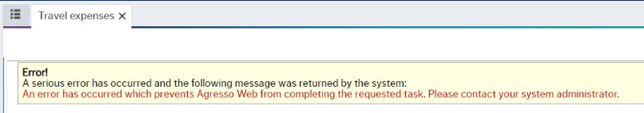

Yes, this is possible, but note there is a technical issue with this so please follow exactly as outlined below.

When entering a currency on the Financial System all you need to do is type the currency code in the currency field e.g. GBP for Sterling and hit the TAB key to move on to the next field.

Note: If you hit the lookup (the box with the three dots) it causes the issue below

If you can't find the currency of the country you visited then please use Euro.

There is no subsistence/conference rate for the country that I need - what should I do?

Travel & Subsistence Foreign Rates

Select the appropriate rate from the above file, enter your expense claim as a Travel: Vouched expenses only, and choose the appropriate expense item from the options listed (e.g. subsistence over 10 hours etc, subsistence over 24 hours).

How do I enter a claim against my Triennial Travel Grant?

Enter the expense claim as a normal "Vouched" claim - however, in Tab 3 - Expenses under the Expense Details heading choose Triennial Travel Grant from the dropdown menu to the right of Expense Type. You can give enter the detail of what the expense item is for in the Description field.

Note: Please do NOT change the budget from the default specified under the GL Analysis section. If you have entered each item entered as a "Triennial Travel Grant" Expense Type it will not charge the claim to your Departmental budget but will come out of your personal Triennial Travel Grant, provided there is enough funding there. Some users are entering D1993 which is incorrect as this is the Triennial Travel Grant budget for the University.

How do I submit a claim for Foreign Police Certificates?

1. The cost centre code to claim costs incurred for Foreign Police Certificates is D0278

Do not submit any expenses to D0278 that do not relate to Foreign Police Certificates Expenses

2. Only expenses incurred in obtaining a Foreign Police Certificate may be claimed as per list below:

- The cost of a Foreign Police Certificate itself

- The cost of having fingerprints taken

- If it was necessary to travel to an Embassy in Dublin

- Related travel expenses

- Travel to countries outside of Ireland may not be claimed.

3. If it was compulsory to courier an application/documents to obtain a Foreign Police Certificate

4. To claim the cost of finger printing select Foreign Police Certificates as the Expense Type.

5. To claim the cost of a courier select Foreign Police Certificates as the Expense Type